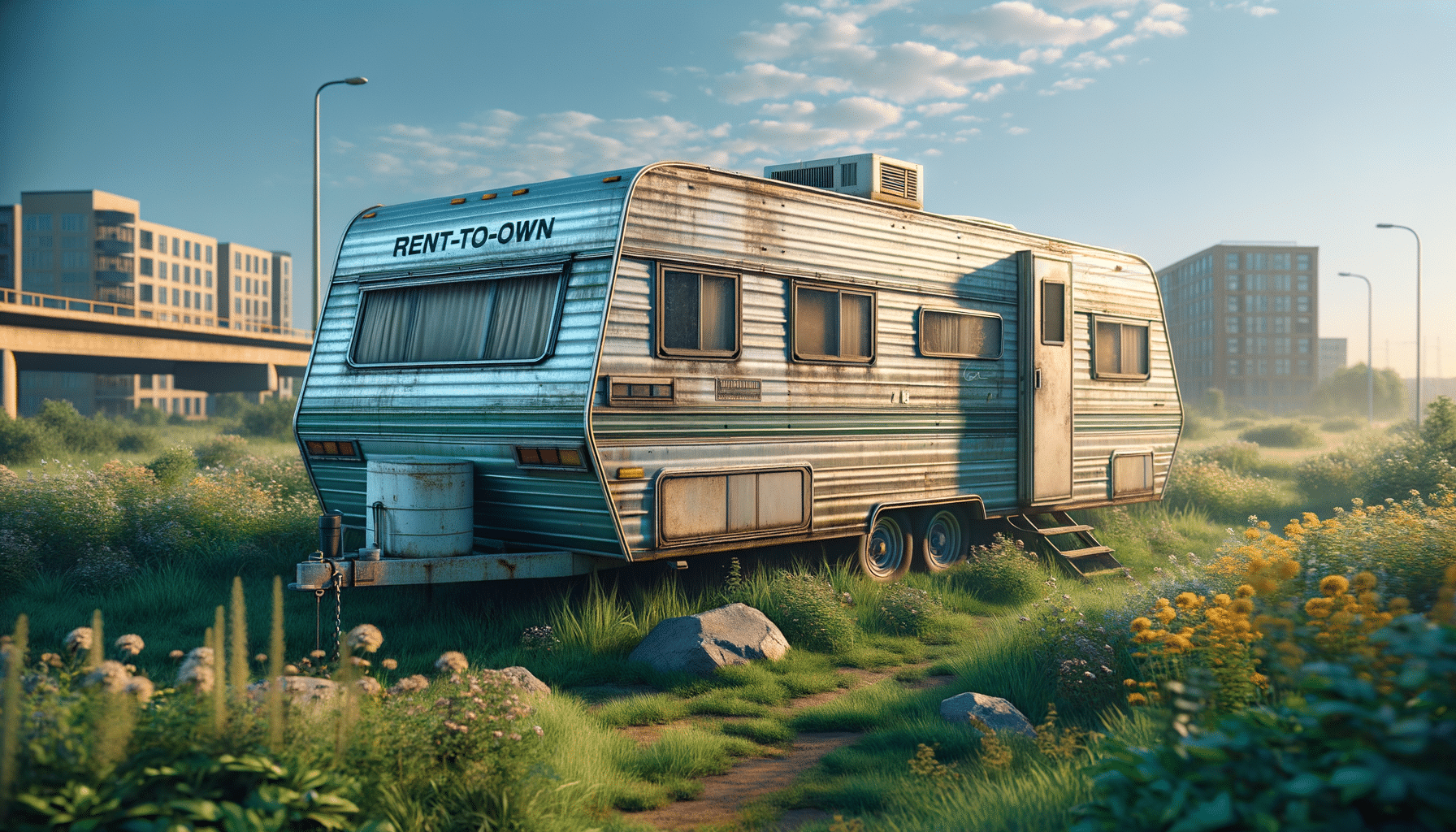

What Is a Rent-to-Own Trailer and How Does It Work?

Understanding the Rent-to-Own Trailer Concept

In today’s fast-paced world, the need for flexibility in large purchases has become increasingly important. This is where the rent-to-own trailer model comes into play. A rent-to-own trailer is essentially a leasing agreement that allows individuals to rent a trailer with the option to purchase it at the end of the rental term. This arrangement is particularly appealing for those who require temporary use of a trailer but are not ready to make a full commitment to buying one outright. It offers the dual benefit of immediate use and the potential for ownership.

The concept is straightforward: you enter into a rental agreement for a specified period, during which you pay monthly rental fees. These payments often contribute towards the eventual purchase price of the trailer. At the end of the lease term, you have the option to buy the trailer, typically at a pre-agreed price, which takes into account the payments you’ve already made. This model provides a pathway to ownership without the immediate financial burden of a large upfront payment.

One of the key benefits of a rent-to-own trailer is the flexibility it offers. It allows individuals to test the waters before fully committing to a purchase, ensuring that the trailer meets their needs and expectations. Additionally, this model can be a viable option for those who may not have the credit score required for traditional financing. By making consistent payments, renters can gradually build their credit while working towards ownership.

Benefits of Choosing a Rent-to-Own Trailer

Choosing a rent-to-own trailer comes with several advantages that cater to a wide range of needs and circumstances. One of the primary benefits is the ability to spread the cost of the trailer over time, making it more accessible for individuals who might not have the funds for an outright purchase. This financial flexibility can be a significant advantage for many, especially those who are just starting out or who may be facing temporary financial constraints.

Another advantage is the opportunity to use the trailer before making a long-term commitment. This can be particularly beneficial for individuals who are new to trailer ownership and want to ensure that the trailer suits their lifestyle and needs. The rent-to-own model effectively serves as an extended trial period, allowing for a thorough evaluation of the trailer’s performance and suitability.

Moreover, a rent-to-own agreement can include maintenance and repair services, which can alleviate the burden of unexpected costs. This can be a decisive factor for those who may be concerned about the potential expenses associated with trailer ownership. By having these services included in the agreement, renters can enjoy peace of mind knowing that they are protected against unforeseen issues.

- Financial flexibility with spread-out payments

- Extended trial period to evaluate the trailer

- Potential inclusion of maintenance and repair services

The Process of Entering a Rent-to-Own Agreement

Embarking on a rent-to-own trailer agreement involves several steps designed to ensure both parties are clear about the terms and conditions. The process typically begins with selecting a trailer that fits your needs. This selection should be based on factors such as size, features, and intended use. It’s important to consider how the trailer will be used to ensure it meets all necessary requirements.

Once a trailer is chosen, the next step is to negotiate the terms of the agreement. This includes the rental period, monthly payment amounts, and any additional conditions such as maintenance responsibilities or early termination options. It’s crucial to understand all terms before signing the agreement to avoid any misunderstandings later on.

After terms are agreed upon, a contract is signed. This contract will outline all the specifics, including the option to purchase at the end of the rental period. It is advisable to have a clear understanding of the purchase option terms, including any credits applied from rental payments towards the purchase price.

Throughout the rental period, renters are expected to adhere to the agreed payment schedule and maintain the trailer in good condition. At the end of the term, you have the option to purchase the trailer or return it, depending on your needs and financial situation at that time.

Comparing Rent-to-Own with Traditional Purchasing

When considering acquiring a trailer, potential buyers often weigh the options of rent-to-own versus traditional purchasing. Each approach has its pros and cons, and the decision largely depends on individual circumstances and preferences.

Traditional purchasing involves paying the full price upfront or securing financing through a loan. This method provides immediate ownership and can be more cost-effective in the long run, as it typically incurs fewer interest charges compared to a rent-to-own arrangement. However, it requires a significant upfront financial commitment and may necessitate a strong credit score to secure favorable financing terms.

In contrast, the rent-to-own model offers a more gradual path to ownership, allowing individuals to make smaller, manageable payments over time. This can be particularly advantageous for those with limited access to credit or who prefer not to deplete their savings with a large initial payment. Additionally, the rent-to-own option provides flexibility, as it allows users to test the trailer before fully committing to ownership.

Ultimately, the choice between rent-to-own and traditional purchasing will depend on factors such as financial situation, credit history, and personal preference for ownership versus flexibility. Both options have their merits, and the right choice will vary based on individual needs and circumstances.

Considerations Before Entering a Rent-to-Own Agreement

Before entering into a rent-to-own trailer agreement, there are several important considerations to keep in mind. First and foremost, it’s essential to evaluate your financial situation to ensure that you can comfortably afford the monthly payments. Understanding your budget and financial commitments is crucial to avoid any potential financial strain.

It’s also important to thoroughly review the terms of the agreement, including any clauses related to maintenance, repairs, and early termination. Being aware of these details can prevent unexpected surprises and ensure that you are fully prepared for any responsibilities associated with the trailer.

Additionally, consider the long-term implications of the agreement. While the rent-to-own model provides flexibility, it may result in higher overall costs compared to a traditional purchase. Weighing the benefits of flexibility against the potential for increased costs is an important step in making an informed decision.

Lastly, assess the trailer’s suitability for your needs. Ensure that it meets your requirements in terms of size, features, and functionality. Taking the time to thoroughly evaluate the trailer can help ensure that it will serve you well throughout the rental period and beyond.

- Evaluate financial capability for monthly payments

- Thoroughly review agreement terms

- Consider long-term cost implications

- Assess trailer suitability for needs