Strategic Business Investment: Maximizing Returns and Minimizing Risks

Introduction to Market Trends and Risk Management

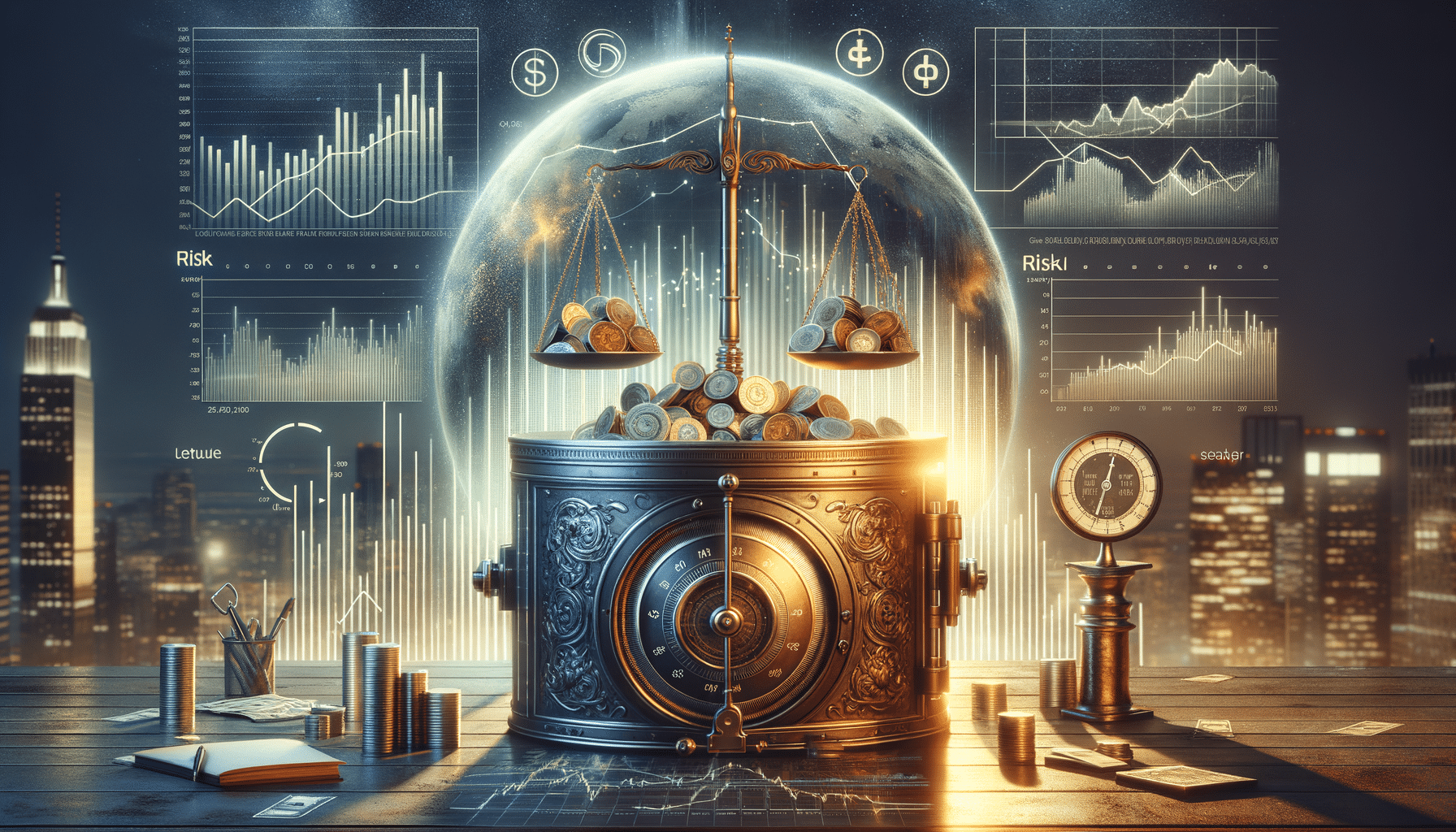

In the dynamic world of business investment, understanding market trends is essential for making informed decisions. Investors rely on economic indicators to guide their strategies and safeguard their capital. This article delves into the intricacies of analyzing market trends and implementing risk management strategies to maximize returns while minimizing potential losses.

Understanding Market Trends: Analyzing Economic Indicators

Market trends are the backbone of investment strategies. They provide insights into the economic environment and help investors predict future market movements. Key economic indicators such as GDP growth, unemployment rates, and inflation are crucial in understanding these trends.

GDP growth, for instance, reflects the economic health of a country. A growing GDP typically indicates a thriving economy, which can lead to increased corporate profits and higher stock prices. Conversely, a declining GDP might signal economic troubles ahead.

Unemployment rates offer another vital clue. High unemployment can reduce consumer spending, affecting company revenues and, subsequently, stock performance. Inflation rates, on the other hand, can erode purchasing power and impact interest rates, influencing bond yields and stock valuations.

Investors analyze these indicators to forecast market directions and adjust their portfolios accordingly. By staying informed about economic trends, they can make strategic decisions that align with their investment goals.

Risk Management in Business Investments

Risk management is a critical component of any investment strategy. It involves identifying, assessing, and prioritizing risks to protect capital. Effective risk management ensures that investors can withstand market volatility and unforeseen events.

Several strategies can be employed to manage risk, including diversification, asset allocation, and hedging. Diversification involves spreading investments across different asset classes to reduce exposure to any single risk. By investing in a mix of stocks, bonds, and other assets, investors can mitigate the impact of a downturn in one sector.

Asset allocation is another key strategy. It involves dividing an investment portfolio among various asset categories based on an investor’s risk tolerance, investment goals, and time horizon. This approach helps balance risk and reward by adjusting the portfolio to suit changing market conditions.

Hedging, on the other hand, involves using financial instruments such as options and futures to offset potential losses. While hedging can be complex, it provides a layer of protection against adverse market movements.

Implementing Effective Investment Strategies

To succeed in business investments, it is crucial to implement effective strategies that incorporate both market trend analysis and risk management. Investors should start by setting clear investment objectives, considering factors such as time frame, risk tolerance, and financial goals.

Once objectives are defined, investors can use economic indicators to guide their investment decisions. By keeping a close eye on market trends, they can identify opportunities and adjust their strategies to capitalize on favorable conditions.

Moreover, incorporating risk management techniques into investment plans is essential. This includes regularly reviewing and rebalancing portfolios to ensure they align with changing market dynamics and personal circumstances.

Successful investors are those who remain adaptable, continuously learning and evolving their strategies to navigate the ever-changing financial landscape.

Conclusion: Navigating the Investment Landscape

In conclusion, understanding market trends and implementing robust risk management strategies are vital for successful business investments. By analyzing economic indicators and employing strategic risk management techniques, investors can protect their capital and maximize returns.

Investing is not without its challenges, but with informed decision-making and a proactive approach, investors can navigate the complexities of the market and achieve their financial objectives.