Maximizing Efficiency: Accounting Automation Tools for Modern Businesses

Introduction to Accounting Automation

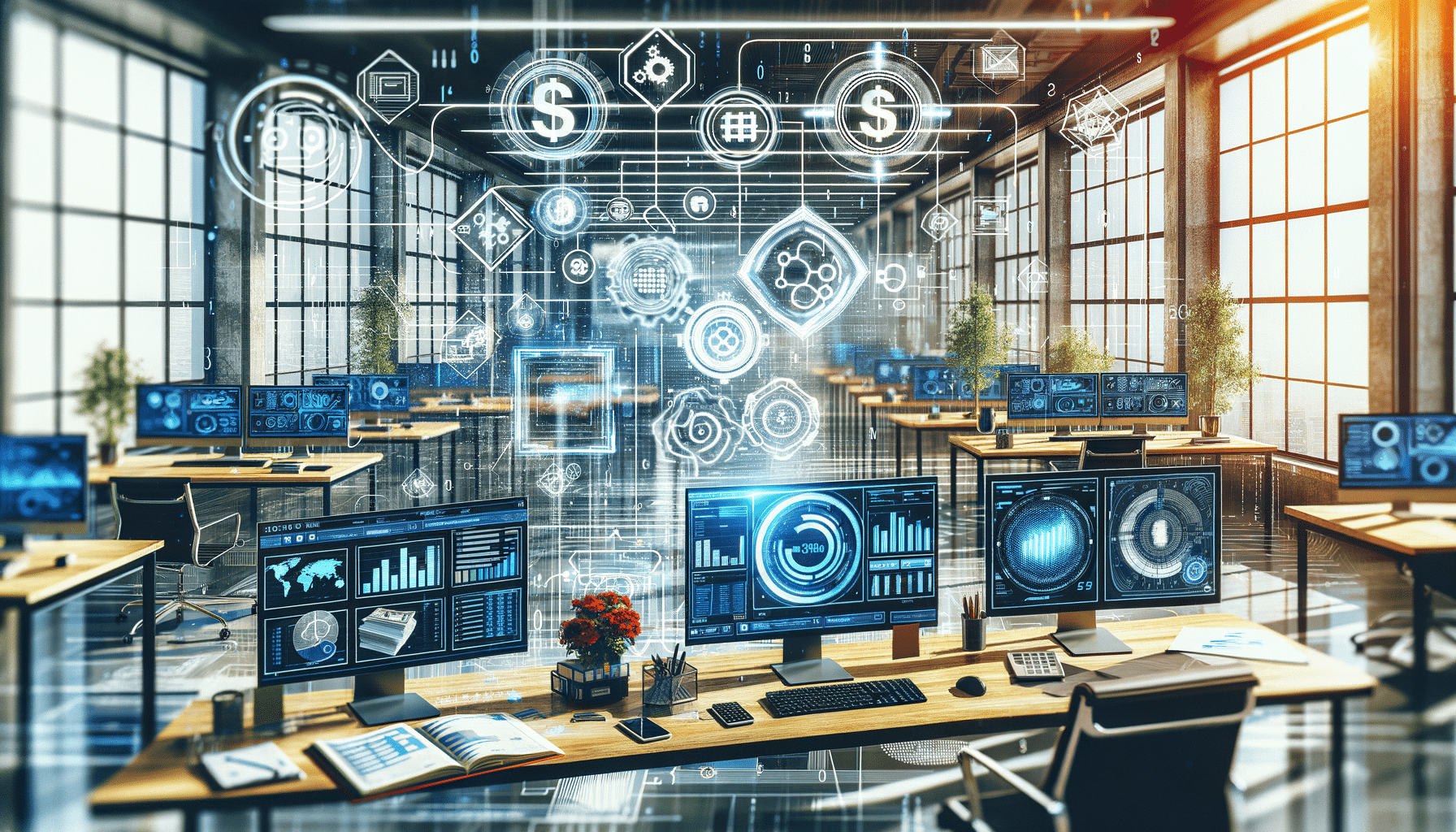

In today’s fast-paced business environment, the demand for efficiency and accuracy in financial management is greater than ever. Accounting automation tools have become essential for modern businesses, helping to streamline operations and reduce the risk of human error. These tools simplify financial processes by automating tasks such as invoicing, payroll, and reporting. By integrating accounting automation into your business, you can focus more on strategic decision-making and less on manual data entry.

Key Features to Look for in Accounting Automation Tools

When selecting an accounting automation tool, it’s crucial to consider the features that will best meet your business needs. Here are some essential features to look for:

- Integration Capabilities: Ensure the tool can seamlessly integrate with your existing systems, such as CRM and ERP software.

- Scalability: Choose a solution that can grow with your business, accommodating increased data and users.

- User-Friendly Interface: A simple and intuitive interface ensures that your team can easily adapt to the new system without extensive training.

- Data Security: Given the sensitive nature of financial data, robust security measures are non-negotiable.

- Customizable Reporting: The ability to generate tailored reports can provide valuable insights specific to your business needs.

Each of these features contributes to the overall effectiveness of the accounting automation tool, ensuring it supports your business in achieving its financial goals.

The Benefits of Integrating Accounting Automation into Your Business

Integrating accounting automation into your business offers numerous advantages that can significantly impact your bottom line. Here are some of the key benefits:

- Increased Efficiency: Automation reduces the time spent on repetitive tasks, allowing your team to focus on more strategic activities.

- Improved Accuracy: By minimizing manual data entry, automation decreases the likelihood of errors in financial records.

- Cost Savings: Streamlining processes can lead to reduced labor costs and improved resource allocation.

- Enhanced Decision-Making: With access to real-time data and customizable reports, businesses can make informed decisions quickly.

- Compliance and Risk Management: Automation tools help ensure compliance with financial regulations and reduce the risk of fraud.

These benefits highlight the transformative impact that accounting automation can have on a business, making it a valuable investment for companies of all sizes.

Implementing Accounting Automation: Best Practices

Successfully implementing accounting automation requires careful planning and execution. Here are some best practices to consider:

- Conduct a Needs Assessment: Identify the specific areas where automation can provide the most value to your business.

- Choose the Right Tool: Evaluate different solutions based on features, cost, and compatibility with your existing systems.

- Involve Key Stakeholders: Engage team members from various departments to ensure the tool meets cross-functional needs.

- Develop a Training Plan: Provide comprehensive training to ensure all users are comfortable with the new system.

- Monitor and Adjust: Continuously assess the tool’s performance and make adjustments as needed to maximize its benefits.

By following these best practices, businesses can ensure a smooth transition to automated accounting and fully leverage the advantages it offers.

Conclusion: Embracing the Future of Accounting

The adoption of accounting automation tools is no longer a luxury but a necessity for businesses aiming to stay competitive in today’s market. By understanding the key features to look for and the benefits of integration, companies can make informed decisions that enhance their financial operations. Implementing these tools not only improves efficiency and accuracy but also empowers businesses to focus on strategic growth. As technology continues to evolve, embracing accounting automation is a step towards a more streamlined and successful future.