Mastering Personal Finance: Strategies for Wealth Building

Introduction to Personal Finance

In a world where financial stability is increasingly vital, understanding personal finance is more important than ever. Whether you’re aiming for financial independence or simply trying to make ends meet, mastering personal finance is a key component of achieving your goals. This article will delve into the essentials of budgeting and wealth-building strategies, providing you with the tools needed to navigate your financial journey effectively.

Budgeting Basics: Laying the Foundation

Creating a personal budget is the cornerstone of financial health. A budget helps you track your income and expenses, ensuring that you’re living within your means. To start, list all sources of income, including your salary, freelance work, or any passive income streams. Next, categorize your expenses: fixed costs like rent and utilities, and variable costs such as groceries and entertainment. This categorization will help you identify areas where you can cut back if necessary.

Once you have a clear picture of your financial situation, set realistic financial goals. Whether it’s saving for a vacation or building an emergency fund, having clear objectives will guide your spending decisions. Remember, a budget is not a static document; it should evolve with your financial situation. Regularly review and adjust your budget to reflect changes in your income or expenses.

Sticking to Your Budget: Tips and Tricks

Creating a budget is one thing, but sticking to it requires discipline and commitment. One effective strategy is the envelope system, where you allocate cash for specific spending categories. This method helps curb overspending by limiting your available funds. Additionally, consider using budgeting apps that track your spending in real-time, offering insights into your financial habits.

Another tip is to automate your savings. Set up automatic transfers to your savings account to ensure you’re consistently putting money aside. This “pay yourself first” approach prioritizes savings over discretionary spending. Lastly, hold yourself accountable by reviewing your budget regularly. This practice will help you identify any deviations and make necessary adjustments.

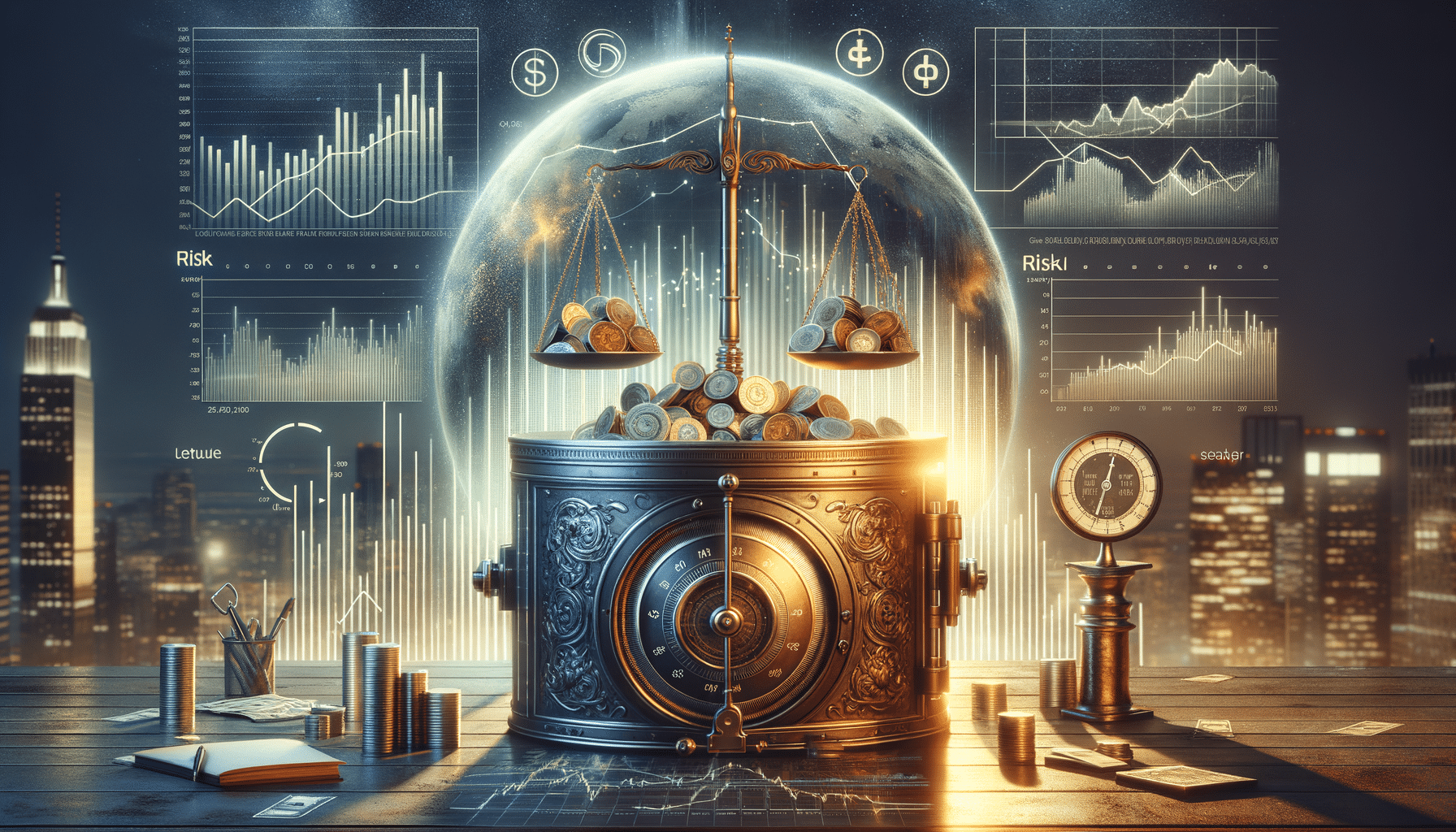

Building Wealth: Essential Strategies

Building wealth is a long-term endeavor that requires a strategic approach. Start by investing in your education and skills, as these can significantly increase your earning potential. Additionally, consider diversifying your income streams. This could involve investing in stocks, real estate, or starting a side business. Diversification not only boosts your income but also mitigates risk.

Another critical aspect of wealth-building is understanding the power of compound interest. By investing early and consistently, you allow your money to grow exponentially over time. Consider retirement accounts and other investment vehicles that offer compound interest benefits. Remember, patience and perseverance are key; wealth-building is a marathon, not a sprint.

Conclusion: Taking Control of Your Financial Future

Mastering personal finance is a journey that requires dedication and continuous learning. By creating and sticking to a budget, you lay the foundation for financial stability. Implementing wealth-building strategies further enhances your financial security, paving the way for a prosperous future. Remember, financial success is within reach, but it requires a proactive and informed approach. Take control of your financial future today, and watch your wealth grow over time.