Comprehensive Single Mother Housing Assistance Programs to Secure Your Future

Outline:

– The housing challenge and why it matters: costs, safety, and the affordability gap for single-mother households

– Federal and state programs: rental vouchers, public housing, tax-credit units, rural options, rapid rehousing

– Local and nonprofit supports: deposits, utilities, legal help, counseling, and short-term relief

– Eligibility and applications: income limits, documents, preferences, waitlists, fair housing rights

– Staying housed and planning ahead: budgeting, energy savings, credit building, and paths to ownership

The Housing Challenge: Why Stable Shelter Matters for Single Mothers

Housing is more than a roof; it is the base camp for work, school, and well-being. For single mothers, the stakes are high because one income must stretch to cover rent, childcare, transportation, and groceries. National surveys consistently show that more than half of single-mother renter households spend over 30% of their income on housing, and roughly a quarter spend over 50%. This “cost-burdened” reality leaves little margin for emergencies. When a car repair, medical bill, or job gap shows up, rent can be the first bill to slip—leading to late fees, notices, or a forced move that destabilizes everything from childcare routines to school attendance.

The pressure has also intensified as rents in many regions rose faster than wages over the last decade. In urban cores with strong job markets, rents can outpace incomes even for steady earners. In rural areas, housing can be less expensive but scarce; a smaller supply means longer searches and limited options that meet safety and commute needs. For single mothers, the time cost of housing searches can also be heavy: every apartment viewing, application, and phone call competes with work shifts, medical appointments, and school pickups.

Stable housing supports measurable gains. Children in stable homes tend to have higher school attendance, fewer behavioral disruptions related to stress, and stronger continuity in after-school programs. Parents often report better sleep and reduced anxiety once rent becomes predictable, which translates into improved job retention and readiness for training or promotions. These benefits compound. A secure address enables enrollment in subsidized childcare, access to local health clinics, and eligibility for utility discounts or food support that further stretch a family’s budget. In short, housing help is not only shelter—it is a lever that lifts multiple parts of life at once.

To navigate this terrain, it helps to know the main categories of assistance and how they fit different needs. Consider how urgent your timeline is, whether you prefer a private rental or an income-restricted unit, and what location supports your children’s schooling and your work commute. A clear strategy—matching your situation to the right program—will save time, reduce stress, and move you from reactive scrambling to proactive planning.

Federal and State Programs: What Exists, How They Work, and Trade-offs

Publicly funded housing assistance arrives through several well-established channels, each with distinct rules, timelines, and advantages. The federal rental voucher program (often called the “housing choice” voucher) helps eligible households rent from private landlords. You typically pay around 30% of your adjusted income toward rent and utilities; the program pays the rest up to a local cap. Strengths include flexibility in choosing neighborhoods and the possibility of “portability” to another community when life changes. Challenges include long waitlists in high-demand areas and the need to find a landlord whose unit passes inspection and meets payment standards.

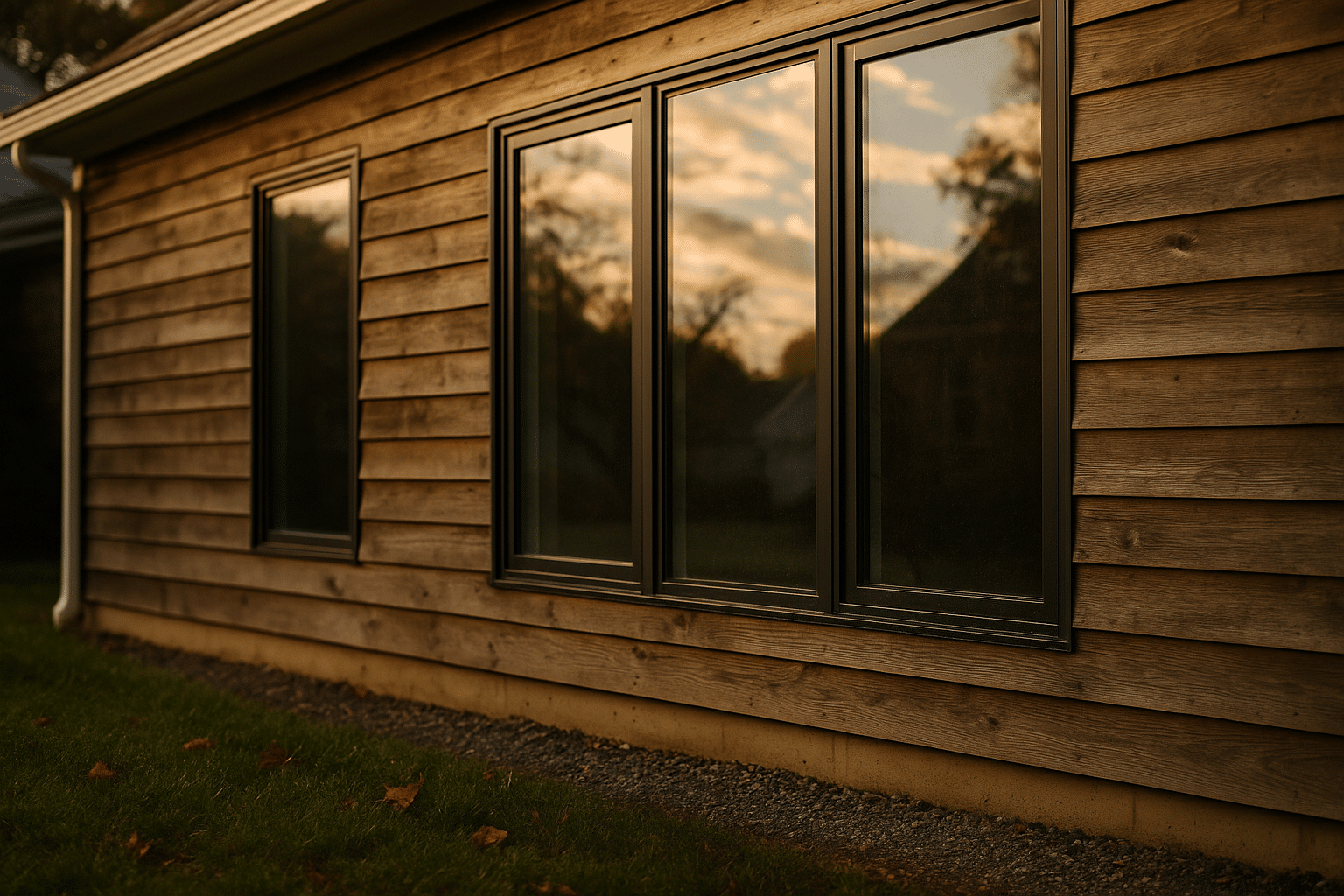

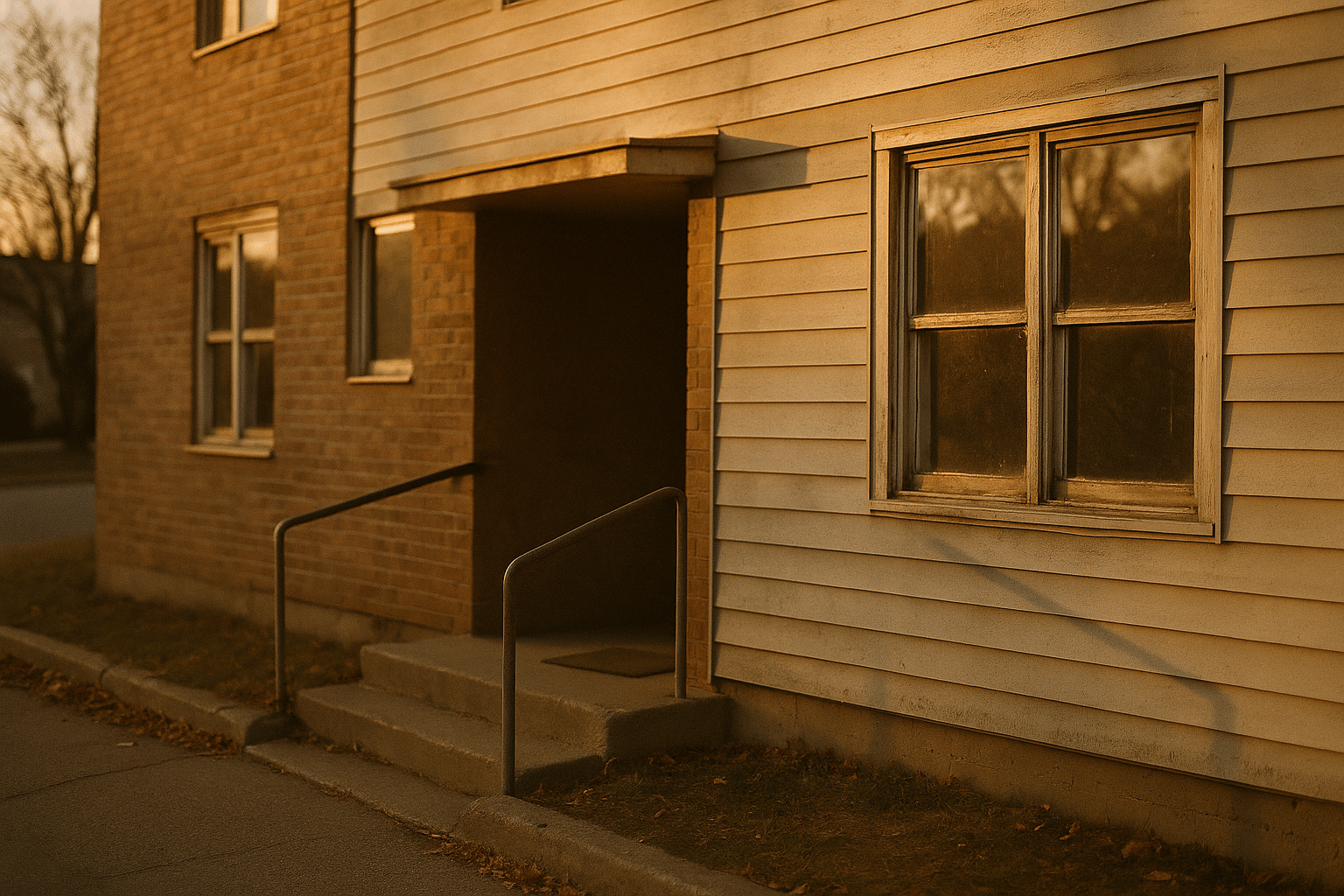

Public housing is owned or overseen by local housing agencies and offers income-based rent. Advantages include predictable costs and maintenance responsibilities handled by the agency. Trade-offs include limited neighborhood choice and the fact that buildings vary in age, amenities, and proximity to work or schools. Project-based assistance, where the subsidy is tied to specific units (including many built with the low-income housing tax credit), can be a strong fit if you find a development near your support network. These units often have modern energy features that keep utility costs down, but vacancies are competitive and may require monitoring multiple property waitlists.

Rural families can explore programs supported by rural housing offices that back both rental assistance and affordable home loans in smaller communities. These options may offer lower monthly payments and down payment flexibility, but they are location-specific and subject to funding cycles. For families experiencing homelessness or fleeing unsafe conditions, rapid rehousing and transitional housing initiatives provide short-term rent support, case management, and help securing permanent housing. They are designed for speed and stabilization, though assistance is time-limited and typically requires active participation in housing searches and goal planning.

Key comparisons to consider:

– Timeline: vouchers and public housing often require long waits; rapid rehousing is faster but temporary.

– Flexibility: vouchers allow private-market choice; project-based units and public housing define location.

– Cost predictability: all income-based programs aim for affordability; utility allowances and energy features can vary by property.

– Mobility: voucher portability can support moving closer to work, school, or family support; project-based assistance is place-bound.

Eligibility is generally tied to area median income (commonly at or below 30–50% thresholds), citizenship or eligible status, background screenings, and household composition. Many local agencies apply preferences for families with children, survivors of violence, veterans, or residents who live or work in the jurisdiction. Understanding these levers helps you choose where to apply first and how to position your application for the strongest chance at a timely offer.

Local and Community Supports: Bridging the Gaps the Big Programs Can’t

Even when you qualify for a major program, timing and logistics can create gaps. This is where state, county, and nonprofit resources step in. Community action agencies, housing counseling services, and neighborhood-based organizations often provide the nimble help that larger systems cannot always deliver quickly. Typical offerings include one-time rental assistance to prevent eviction, help with security deposits or application fees, and utility arrears grants that keep power, heat, or water on during a tough month. Some organizations also run short-term motel vouchers during emergencies and connect families to shelters designed for privacy and safety.

Legal support can be pivotal. If you face an eviction filing or need to negotiate a repayment plan, local legal aid clinics may help you understand your rights, identify defenses, or resolve disputes before they escalate. Mediation programs sometimes repair landlord-tenant relationships by aligning expectations and timelines. Housing navigators—caseworkers who know landlords, unit availability, and inspection requirements—can reduce the trial-and-error that wears families down. For single mothers juggling packed schedules, a navigator’s contacts can mean the difference between a rejected application and a signed lease.

Many communities also maintain centralized intake systems that match your circumstances with available resources. These systems can assign a case manager, prioritize families with children, and point you toward openings across multiple properties at once. Combined with childcare referrals and transportation passes, these supports help sustain housing after move-in. Look for programs that offer budgeting classes, tenant education, and credit-building tools; the right coaching can lower costs and improve approval odds for future housing applications.

Practical ways local supports fill critical needs:

– One-time payments: security deposits, last month’s rent, or utility reconnection fees

– Short-term stability: motel vouchers, flexible subleases, and rapid placement into available units

– Tenant rights: help responding to notices, correcting errors, or requesting repairs without retaliation

– Skill-building: workshops on reading leases, documenting communications, and preparing for inspections

When you combine local and community support with federal or state programs, you create a layered safety net: long-term affordability paired with short-term problem solving. This stackable approach increases resilience, giving you options if a job shift, illness, or school change pushes you off balance.

Qualifying and Applying: Documents, Eligibility Rules, and Smarter Timing

Strong applications begin with preparation. Most programs verify income, household size, identification, and housing history. Gather pay stubs or benefit statements, your most recent tax filing if you have one, photo IDs for adults, birth certificates for children, and any custody or guardianship paperwork. If you receive child support, keep records of payments or official statements showing the amount owed. Save past leases, landlord references, and proof of on-time payments; even a simple ledger of dates and amounts can help. If you lack documents due to moves or crises, ask about acceptable alternatives such as employer letters, school enrollment records, or self-certification forms used temporarily until official documents arrive.

Income limits hinge on the area median income (AMI), which differs by county and household size. Programs often set thresholds at 30%, 50%, or 60% of AMI. Some offer priority to families with children, survivors of abuse, people with disabilities, or those who live or work in the jurisdiction. Background checks typically screen for recent serious offenses and prior program violations; policies vary, and many agencies consider mitigating circumstances or offer appeal processes. If you have a disability, you may request reasonable accommodations—for example, extra time for paperwork or communication by text instead of phone calls if that’s more accessible.

Timing strategies can improve your chances:

– Apply to multiple waitlists: project-based properties, public housing, and vouchers if open

– Check openings weekly: properties funded by tax credits often reopen lists briefly

– Ask about preferences: verifying local residence or employment may help

– Prepare for inspections: begin gathering documents like proof of utilities, children’s school addresses, and a move-in checklist

Beware of fees or “guaranteed approval” promises. Legitimate programs do not require large upfront payments for access, and information should be available through government portals or recognized community organizations. Keep personal information safe; share sensitive details only on verified applications or with assigned caseworkers. If an offer sounds too good to be true, consult a housing counselor or legal aid before sending money or identification.

Finally, be persistent and organized. Create a simple tracker with application dates, contact info, required documents, and next steps. Set calendar reminders for follow-ups and re-certifications. Persistence is not just a virtue here; it is a practical tool for staying near the top of lists, responding quickly to openings, and demonstrating reliability to landlords and agencies.

Staying Housed: Budgeting, Energy Savings, Credit Care, and Next Steps to Ownership

Securing a lease is a milestone, but sustaining it is the real victory. Start with a realistic budget anchored to your rent and utilities. Suppose your rent is income-based at roughly 30% of your adjusted income; aim to build a small cushion—even $10–$25 per paycheck—into an emergency envelope. Automate what you can: partial payments on payday and scheduled utility drafts tame “bill pileup” weeks. If childcare costs spike certain months, mark those in advance and offset with extra savings on lighter months. Many single parents find that a predictable bill rhythm reduces stress and late fees dramatically.

Utility costs are the stealth line item that can topple a monthly plan. Ask your property manager or utility company about budget billing, energy audits, and weatherization programs that may be free to income-eligible households. Small steps—LED bulbs, draft stoppers, air filter changes, and careful use of laundry heat—trim recurring costs. If your unit qualifies for energy assistance during extreme seasons, apply early; funds can run out. Document any maintenance issues that could inflate bills, such as leaking faucets or faulty seals on windows, and submit repair requests promptly.

Credit and rental history affect future housing choices. Consider secured cards or rent-reporting services that safely add on-time payments to your credit file. Keep utilization low and set alerts for due dates. If you have medical or emergency debt, seek counseling to prioritize debts that affect housing access. Over time, an improving credit profile opens the door to more units, lower deposits, and eventually, pathways to ownership.

Looking ahead, some programs support transitions to buying. Down payment assistance, matched savings accounts, and homebuyer education can make ownership feasible when the timing is right. Key steps to prepare:

– Build a steady savings habit, even in small amounts

– Track your credit score quarterly and dispute clear errors

– Learn about mortgage affordability rules and inspection basics

– Estimate total monthly costs beyond principal and interest (taxes, insurance, maintenance)

Day to day, strengthen your tenancy by communicating early with your landlord, documenting repairs, and keeping copies of all notices. Attend re-certification appointments on time and report income changes promptly to avoid retroactive charges. If life throws a curveball—a job loss, a health issue—reach out to your case manager or local support hub immediately. Early conversations often unlock solutions like temporary rent reductions, partial payments, or emergency grants that keep your family stable while you regroup.